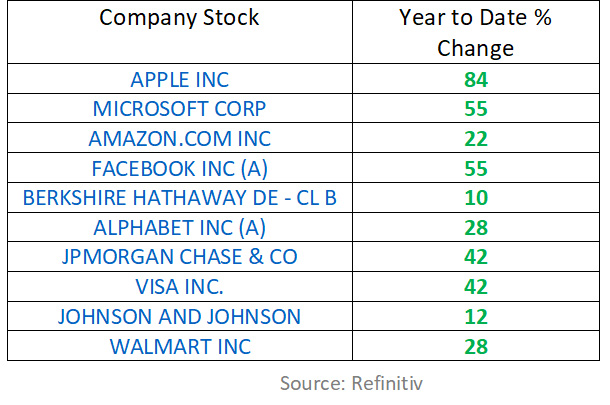

Investment markets in the US performed well in 2019, but investing hasn’t been nearly as easy for stock pickers unless you put your money in Apple, Microsoft or Facebook stock. (Apple is up 80% this year which is staggering considering the market value of the company as of December 27th is $1.2trillion – that’s $1 million dollars multiplied by 1,200,000!)

Top 10 stocks in the S&P 500 and their year to date change as of 12/30/19.

2019 has been a stellar year in absolute terms with the S&P 500 up 28%. It is exciting, but it has also been a bit of a mirage. You see, the US stock market bottomed out last Christmas when it fell 19% from October 1, 2018 to December 24th, 2018. If you back up the clock a few months to October 1st of 2018 and measure to today, the S&P 500 is up 10% – hardly record-breaking or newsworthy numbers. And, if you look at the Value Line Geometric Average (a broader index of 1,600 US companies) that is equally weighted, that index is down 5% from October 1st, 2018 to today meaning that the average stock is down 5% over that period!

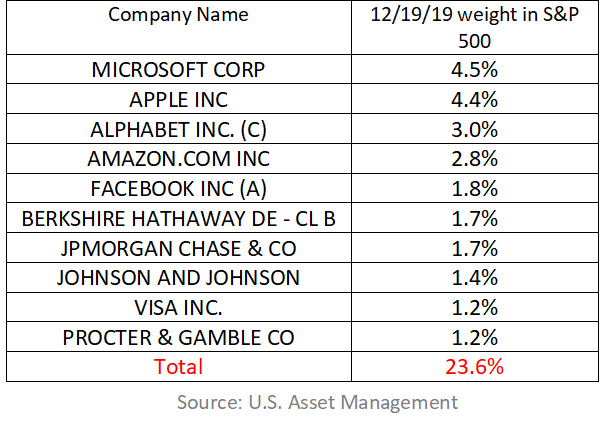

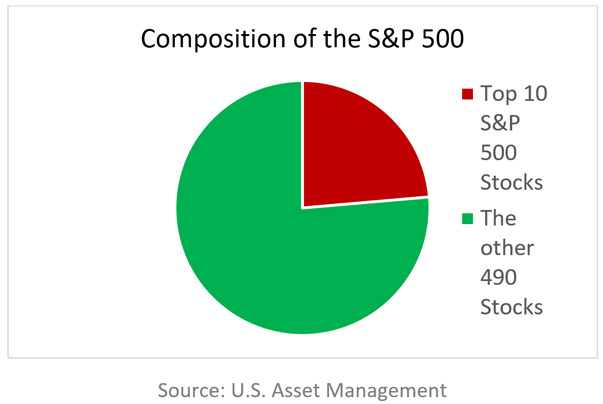

So, what’s going on? Simple – the S&P 500 is 500 stocks just like the name says but what most people don’t know is that the top 10 stocks make up a disproportionately large percentage of the index. That means, the top 10 companies make up over 22% of the index while the other 490 make up the other 78%.

All this is to say that we have had a disproportionate move in a small number of very large stocks. It is an unsustainable move that I do not think will repeat next year,

For 10 years, I have been on my soap box telling anyone who will listen, that stocks were going higher. I am climbing down from my soap box – for a little while anyway.

Based on our models, we think U.S. stocks have limited return potential for the next 12 months. We built a tool that calculates what the Dow Jones Industrial Average might be 1 year from now. If each stock reaches its median price target set by the analysts who have a published a target in the Reuters/ThomsonOne universe, the in Dow Jones Industrial Average will be about 29,926 in a year. That’s just 5% higher from here and not enough to get me excited about U.S. stocks.

Why? Because stocks can drop 5 to 10% in a month a 5% upside in a year is not a good risk-return trade off, in our opinion. Therefore, we have reduced our US stock exposure and shifted money to other areas that we believe have greater potential. Where do we see potential? That’s in our next article.

If you have questions about how to invest for your situation, contact me directly at david.cross@us-am.com or call me at 678-894-0697.

David.Cross@us-am.com