As I mentioned in the last article, we see limited upside potential for US stocks in 2020. Our estimate of fair value on the Dow Jones Industrial Average for year end 2020 is about 30,000. Could stocks go up beyond our fair value estimate? Yes, that is possible, but we don’t recommend chasing the prices up any more than I would suggest overpaying for a home. Over the long run, the value can rise but the smartest real estate investors I know have always told me the you make money from a good purchase price, not necessarily the selling price. Therefore, be patient and picky with what you pay.

OPPORTUNITIES

Speaking of smart real estate investors, in a recent interview on Bloomberg, real estate tycoon, Sam Zell said he “has acquired oil assets across the United States at ‘fire-sale’ prices, as U.S. drillers sell assets to raise cash which is scarce in the oil patch these days”. Zell is the founder and chairman of Equity Group Investments. He made a fortune in distressed real estate in the 1990s and later. He has confirmed that he bought assets of oil companies in Texas, Colorado, and California at advantageous prices because firms are increasingly looking to have cash buffers because they anticipate a potential further slowdown in drilling. (source: Bloomberg)

“The amount of capital available in the oil patch is disappearing,” Zell told Bloomberg, comparing the U.S. oil industry now with the early-1990s real estate sector when no one had cash.

At our company, we use a proprietary tool that we developed to identify investment candidates. So far, we also see attractive opportunities in the energy sector and other areas, but we use mutual funds and Exchange Traded Funds (ETFs) to buy a basket of a several dozen companies instead of individual stocks.

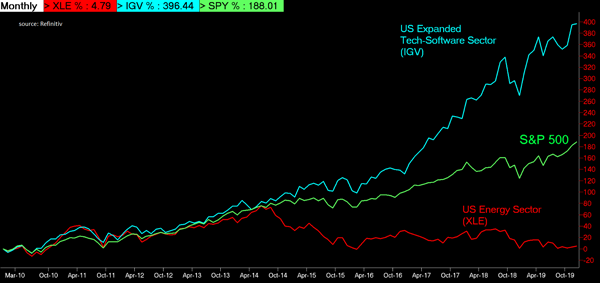

One sign that energy companies may be attractive is the low returns they have provided over the last 10 years. As you can see from the graph below, on a price basis (not including dividends) Energy stocks as a group have returned 4.82% cumulatively over the last 10 years. The S&P 500 has increased 188% versus the hottest group, Software stocks which have increased 396% over the last 10 years.

Another area that we think may be attractive is international investments. Over the last 10 years, US stocks, have increased about 187% while international stocks have only returned 25%. International stocks may not sound appealing especially when US stocks are doing so well but many international companies are well known household brands like Nestle, Novartis, Toyota, L’Oréal, Sony, Daimler, Prudential, Honda, Adidas and Diego (makers of Johnny Walker, Captain Morgan, Ketel One, Crown Royal) to name a few.

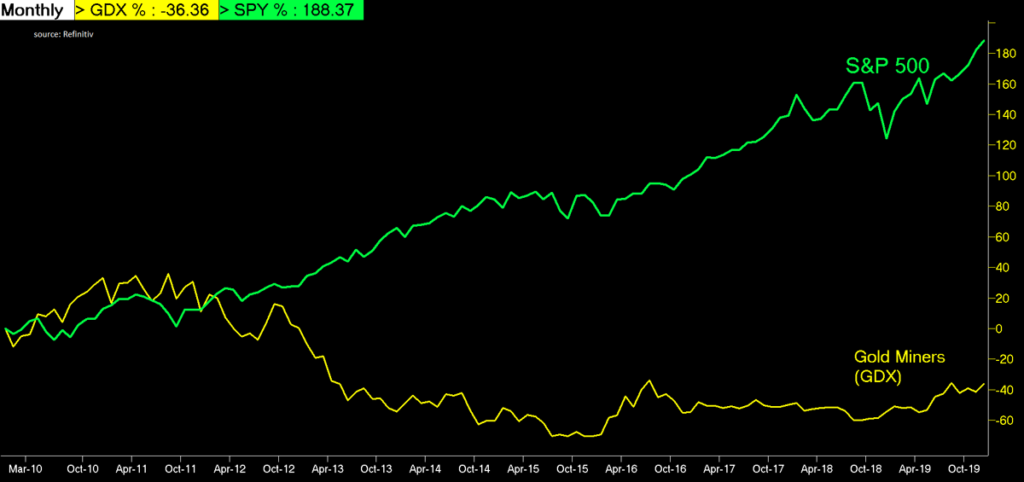

Another area where we see potential value is in gold mining. Over the last 10 years, the gold mining sector, represented by the VanEck Vectors Gold Miners ETF (GDX) has declined 36% while US Blue Chips has increased 188%. We feel like there is a possibility that gold bullion and gold miners could do well considering governments around the world printing so much paper money. Gold is just another form of currency, but it is limited by how much has been mined and how much may be mined. It is not nearly as easy to produce $1,000,000 of gold as $1,000,000 in dollar bills.

Yet another area that looks interesting to us is Uranium mining. In the last 10 years, the sector has been devastated as Russia and China have teamed up with Kazakhstan to dump vast quantities of uranium into the market to put North American producers out of business and control the market for the metal. The plan has nearly worked but a consortium of US producers recently asked President Trump to order US nuclear power plants to buy from US suppliers. At first, the President balked at the idea but now he is studying the proposal. That said, our work seems to indicate that there is significant value in these esoteric miners even if nothing happens.

Financial market commentators seem to be cheer leading the stock market with each tiny fractional point gain that lands at a new “all time high” – cue the balloon drop. They are great at making you feel panicky when things are going down and they make you feel stupid for missing out when the market is charging higher. We suggest you turn off the TV and let the data drive your decisions. We think the US market may be entering a period of slower growth in what has already done well, and we may see a shift in performance to a more value-oriented investment style.

Time will tell, but for the moment, we are being cautious and moving to value.

David.Cross@us-am.com