by: David Cross, CPM® ,CDFA®, CRPC®

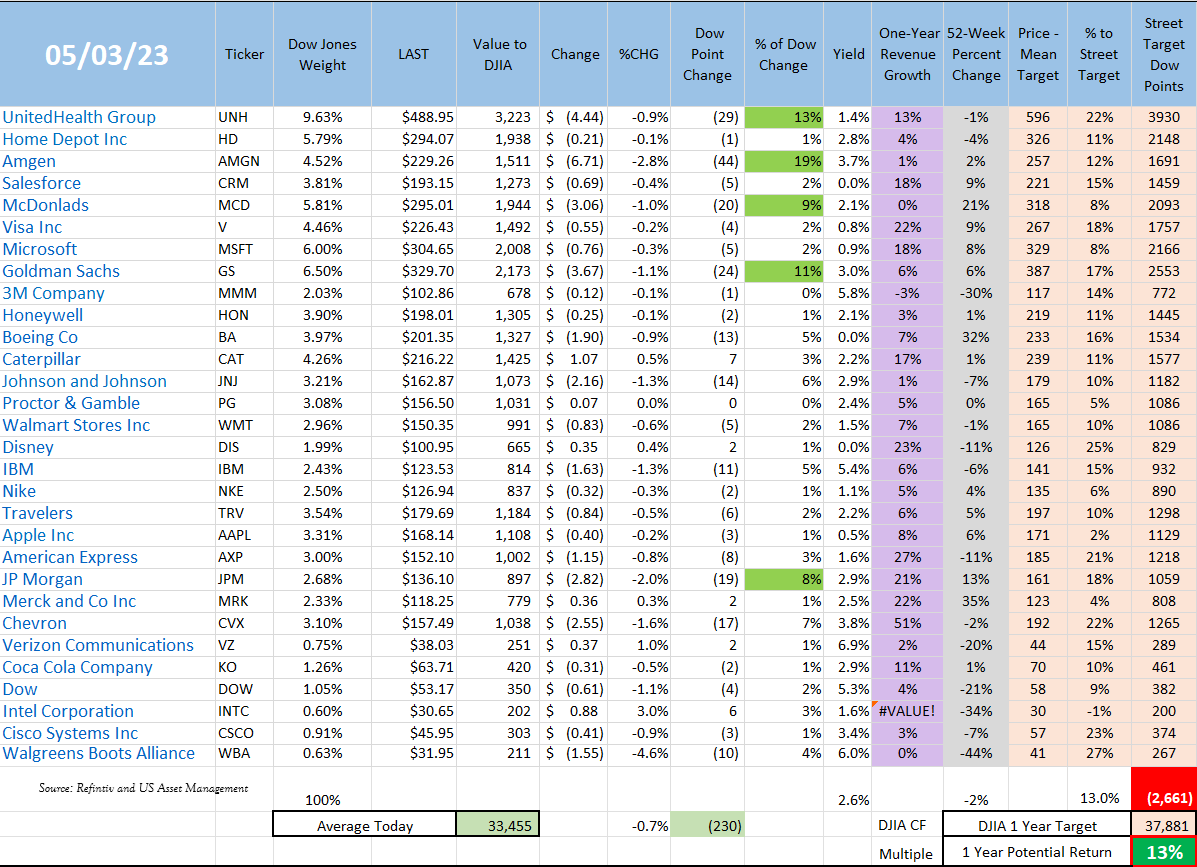

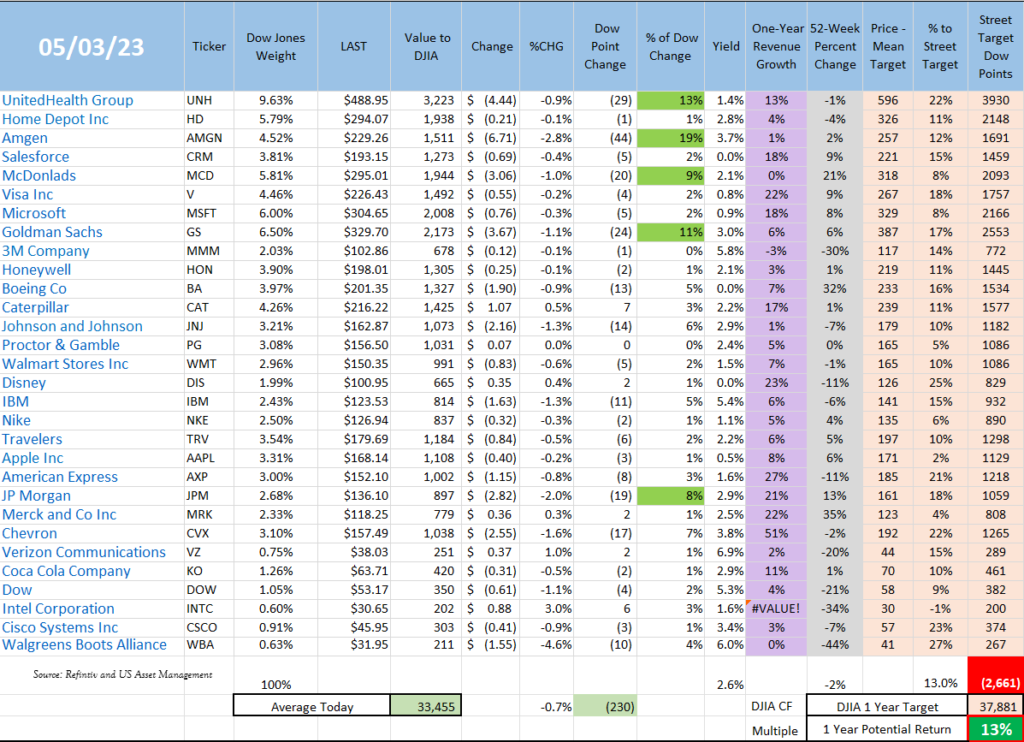

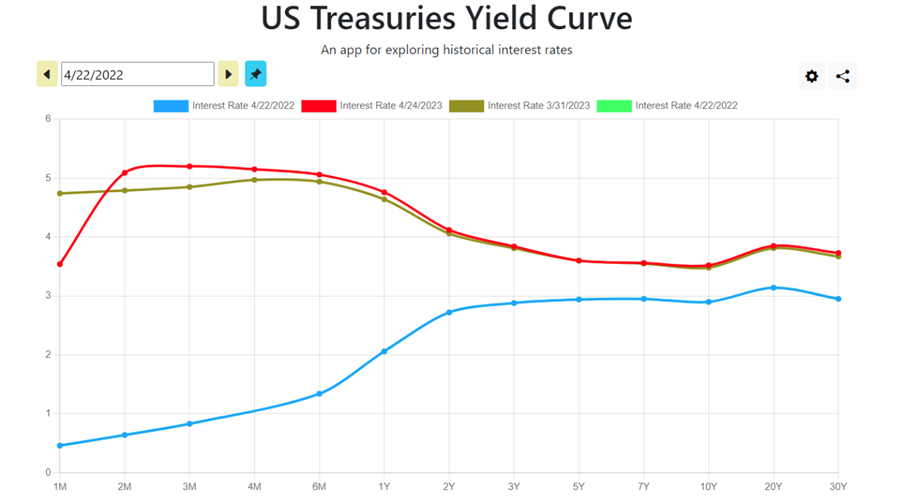

Exactly 1 year ago, the Dow Jones Industrial Average was at 34,049. As of last week, it sat at 33,875 – a difference of only 175 points, a rounding error of about ½ of 1%. If you were Rumpelstiltskin, and you fell asleep for a year, you would think nothing had happened in the world – and you would be so wrong. The world is a vastly different place today than a year ago. Today, our indicator points to the Dow Jones Industrial Average perhaps being 11% higher a year from now.

Source: Refintiv

What’s happening?

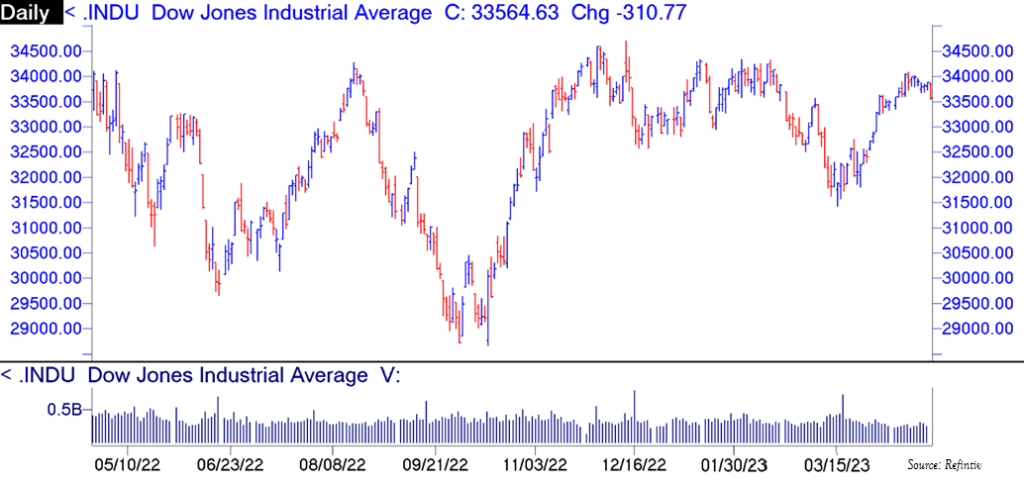

Treasury bond yields have swung wildly in the past year with the one-month Treasury bond paying about 0.50% then (blue line) to over 3.5% today (red line) and nearly 5% a few weeks ago (gold line). Higher interest rates make financing large purchases, like a home, more expensive. Higher interest rates drive up the cost of financing large purchase and can slow the economy.

Source: https://www.ustreasuryyieldcurve.com/ https://www.ustreasuryyieldcurve.com/b/Cuoiy8

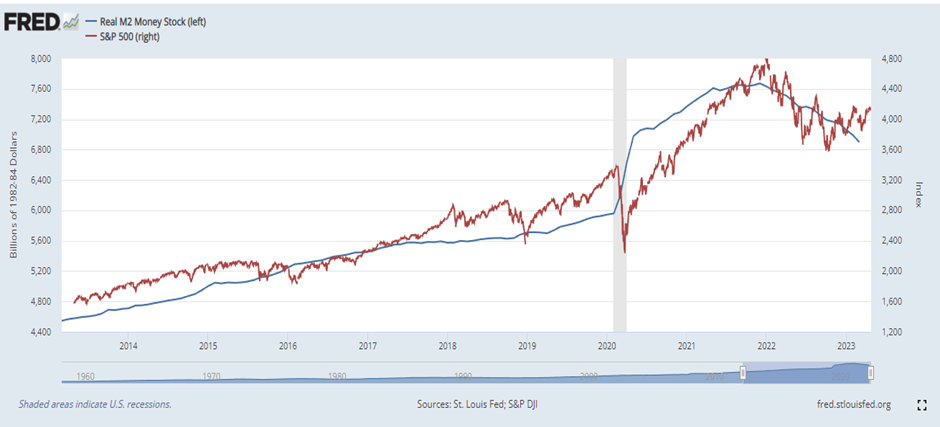

The Federal Reserve, in coordination with the Treasury, increased the money supply rapidly for over a decade – until January of last year. When the Fed began contracting the money supply, the stock market followed along. There is a strong correlation between the money supply and the stock market. When the Fed cuts the supply of money, I would expect to see stock prices fall and that looks to be the case now.

Where are we today?

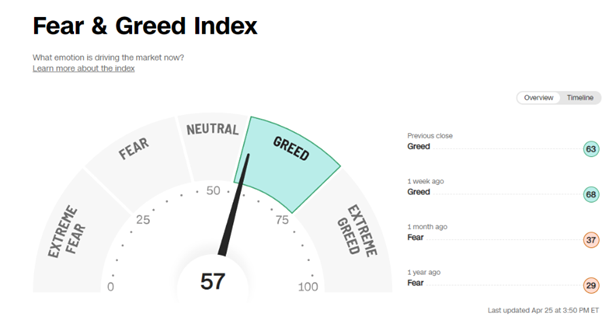

Based on the CNN Fear & Greed Index, investors are behaving a little bit greedy. Generally, we want to do the opposite of the masses at the extreme readings of the Fear & Greed Index. So, when other investors are feverishly pushing stock prices higher the index will point to “extreme greed” we want to be selling or atleast not buying. When the investors are panicing, the index will point to “extreme fear”, and that is the time we want to be looking to buy stocks.

A keen observation

A friend of mine reminded me many years ago that when McDonalds stock is doing well, it is an indicator that people are economizing. McDonald’s is at an all time high – not a good sign for the economy.

Source: Refinitiv

And, recently, Samsung announced their worst quarterly profit since 2009 which was a very tough year. Another sign of a slowing economy.

Source: Techcrunch

What’s the bottom line?

Although no one can predict the future, it is our opinion that the stock market can decrease by 10% at any given moment and if our calculations are correct, the one-year estimated upside is around 10%. Those are not favorable odds, to me so it may be best to wait for a dip to buy stocks.

If you have questions about the market or your investments, we invite you to ask questions. Call us at 678-894-0696 or email us at david.cross@us-am.com

Disclosure: This material is provided as a courtesy and for educational purposes only. Please consult your investment professional, legal or tax advisor for specific information pertaining to your situation. This material does not constitute a recommendation or a solicitation or offer of the purchase or sale of securities.

All information contained herein is derived from sources deemed to be reliable but cannot be guaranteed. All economic and performance data is historical and not indicative of future results. All views/opinions expressed in this newsletter are solely those of the author and do not reflect the views/opinions held by Advisory Services Network, LLC. The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The term “Nasdaq” is also used to refer to the Nasdaq Composite, an index of more than 3,000 stocks listed on the Nasdaq exchange that includes the world’s foremost technology and biotech giants. The Dow Jones Industrial Average (DJIA) is a price-weighted index of thirty actively traded blue chip stocks. Indexes are unmanaged and do not incur management fees, costs, or expenses. It is not possible to invest directly in an index.

678-894-0696