CPA’s listen up! As you begin preparing tax returns, some of your clients may have lost money last year but still owe capital gains taxes because their mutual funds paid year-end “capital gains distributions”.

“A capital gains distribution is a payment to mutual fund shareholders that is prompted by a fund manager’s liquidation of underlying stocks and securities in a mutual fund, or derived from dividend and interest earned by the fund’s holdings minus the fund’s operating expenses. Capital gains distributions must be made by a mutual fund manager because tax law dictates that substantial portion of investment income and capital gains must be paid to investors.” – Investopedia

Capital gains distributions seem to happen randomly to the casual observer but, you may be able to anticipate and even potentially avoid them if your client has a tax-aware portfolio manager.

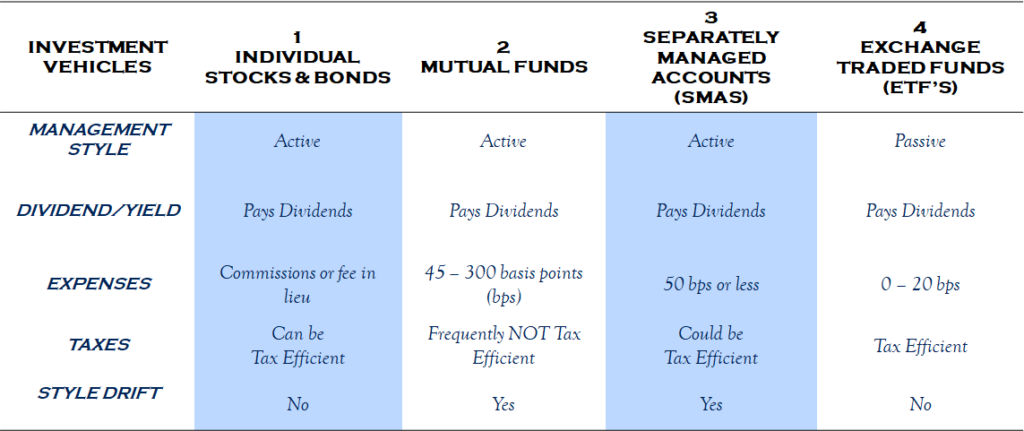

As a CPA you know that equity ownership in businesses is one of the best ways to build long-term wealth. However, what you make and what you keep may be 2 different numbers. When it comes to stocks, there are 4 basic ways to own them: individual stocks, mutual funds, Separately managed accounts, and Exchange Traded Funds. Some forms of ownership are more efficient than others and some forms of ownership are more cost effective than others – see figure below:

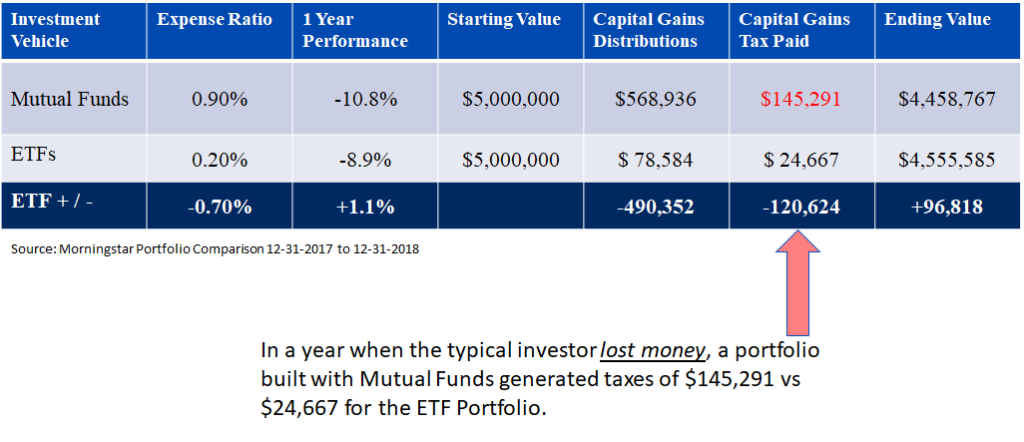

Owning a tax efficient portfolio may help reduce the burden of unnecessary taxes. For example, a client with $5 million invested in some popular mutual funds last year generated capital gains distributions of over $568,000 and taxes of over $145,000. And, they still lost money because stocks broadly declined.

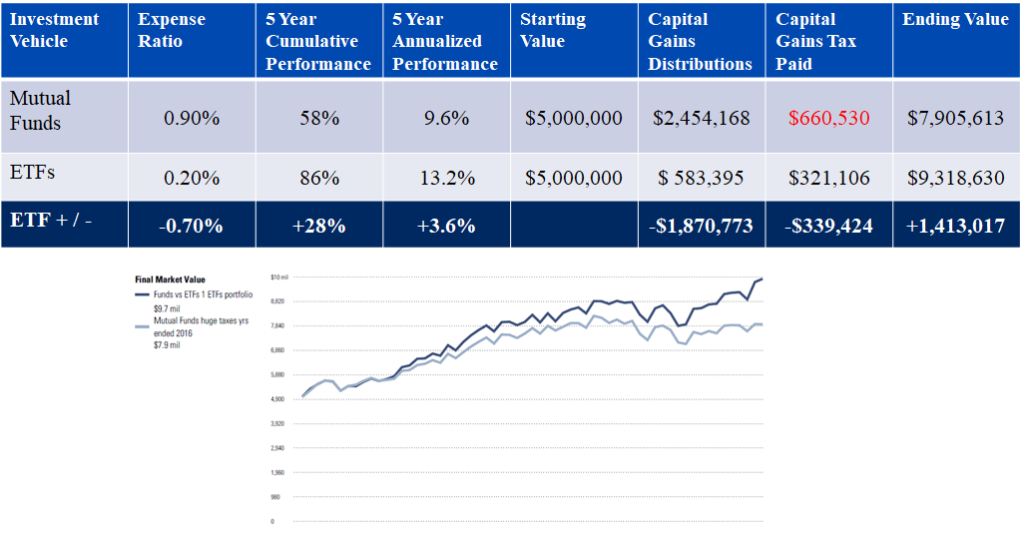

Over a 5-year period from December 31, 2011 to December 31, 2016 the tax impact was significantly magnified. The same mutual fund portfolio generated capital gains of over $2.4 million and taxes of $660,000!

Source: Morningstar and U.S. Asset Management

You may be thinking, “I don’t have that many clients with $5 million in mutual funds” but even if you divide the numbers by 5 or 10, you can still see that there can be a significant tax drag on your client’s investments.

Taxes from Capital Gains may get worse

The market decline and elevated volatility of 2018 prompted some steep drops in some of the biggest and most widely held stocks. Continued volatility coupled with continued redemptions out of mutual funds, is likely to trigger more capital gains distributions in 2019. Those gains will likely be spread over a smaller shareholder base. Larger gains in the numerator and fewer shareholders in the denominator equals bigger taxes for the average fund shareholder in the future.

What can you do about Capital Gains Taxes?

Be aware of your client’s investment strategy and look for those who have heavy mutual fund holdings in taxable accounts. Discuss the possibility that large capital gains distributions may occur and how they may be able to avoid some capital gains tax distributions. While no strategy is perfect and there are some ETFs that can generate capital gains distributions under certain circumstances, you can help your client mitigate the risks. To find out if your client is at risk this year, ask if your client’s advisor has access to the Morningstar Advisor Workstation, a premium service. The workstation tool can help assess a single fund or an entire portfolio for potential embedded tax risks. Together, with the help of tax-aware advisor, you may be able to help your clients avoid unnecessary taxes.

David.Cross@us-am.com