“How do you think we’re doing for people our age?”

This is the question I’m often asked when interviewing a client to construct their financial plan. There are various formulas people use, but the truth is, it all depends upon your lifestyle.

Here’s why your lifestyle matters. If you are about to retire, and it takes $100,000 each year to maintain your lifestyle, but you only have $500,000 set aside, you have a problem. Here’s why. Your $500,000 can realistically generate $20,000 to $25,000 per year. If Social Security pays you $24,000 each year and you add that to the $25,000 from your investments, then your income is $49,000; and you are $51,000 short of maintaining your lifestyle. However, if your lifestyle only requires $40,000 each year, that same amount of money may be sufficient.

According to Fidelity Investments1, the largest provider a 401 K plans in the United States, here’s what people have set aside in their retirement accounts based on different age groups. You may have more, and I hope you do.

Age 20 – 29: $11,500

Age 30 – 39: $42,700

Age 40 – 49: $103,500

Age 50 – 59: $174,200

Age 60 – 69: $192,800

How am I doing relative to other people saving for retirement?

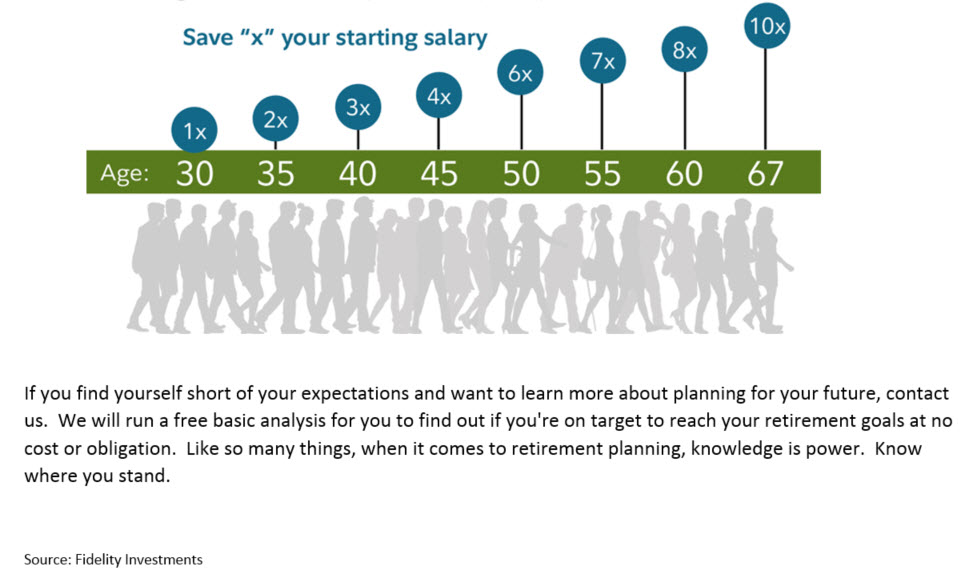

Fidelity has developed a rule of thumb to help you figure out approximately how much you had should have saved at different points in your life to account for your lifestyle. Again, this is their formula, and what really matters more is what you were spending each year as opposed to your income.

By age 30: Have the equivalent of your salary saved

By age 35: Have two times your salary saved

By age 40: Have three times your salary saved

By age 45: Have four times your salary saved

By age 50: Have six times your salary saved

By age 55: Have seven times your salary saved

By age 60: Have eight times your salary saved

By age 67: Have 10 times your salary saved

Saving factors to help you on your journey to retirement

David.Cross@us-am.com