I really don’t like writing updates like this but I feel like it is an efficient way for me to give you a thoughtful update without me having 100 similar conversations in a day or two. This brief will give you some essential information and I certainly welcome your call if you have additional questions. Please pardon the occasional non-technical tone – you know that I speak directly and plainly so here goes…

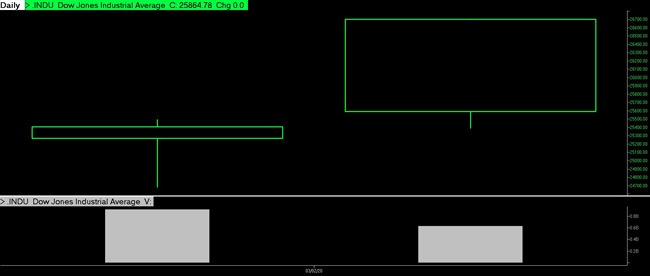

It appears we have a full-blown global financial panic on our hands. As I write this at 10 pm Sunday evening, March 8th, Dow Jones stock market futures are indicated down another 1,300 points or 5%. Before this all began, the Dow Jones was at 29,500. Tonight, we are at 24,500 or about 17% lower than 3 weeks ago.

My assessment is that I thought the virus concern was overblown 2 weeks ago. Now it is WAY overblown. Companies are cancelling meetings, conventions and travel out of an abundance of caution, because let’s face it, if even one person gets sick, the company may be liable and they have a public relations nightmare on their hands. It is the same story for governments, like Italy, who are restricting travel for citizens to slow the spread of the virus.

According to the BBC, as of tonight, Italy has the highest death rate among any nation. What the news doesn’t tell you is that Italy also has the oldest population in the world and China has so many visitors to Italy that the Chinese government set up a special police force in Venice. Because Coronavirus appears to disproportionally affects those over 65 it’s no wonder that the death rate is rising in Italy.

From what I’ve heard, the symptoms for Coronavirus may be so mild that many people infected will have no idea they are sick and will recover without ever knowing they had the virus.

According to Dr. Richard Martinello, an associate professor of medicine at Yale specializing in infectious diseases, roughly 85% of those who contract the coronavirus will have mild to moderate symptoms that can be treated at home. Source: The Connecticut Mirror

How bad could this be? – source: STAT News

The WHO says data from China suggests about 82% of confirmed cases have only mild infection, about 15% are severe enough to require hospital care, and about 3% need intensive care.

To calculate the fatality rate you have to have a good idea of how many people have actually been infected and how many have died. Because so many people likely have mild infections and haven’t been counted, it’s impossible at this stage to know the fatality rate for sure.

“If we’ve very fortunate, there are tons of mild cases being missed and maybe it’s 0.4% or something … which is big,” says infectious diseases epidemiologist Marc Lipsitch a professor at Harvard’s T.H. Chan School of Public Health. “But that would be a lot of mild cases missed.”

I’m certainly no epidemiologist but I do know numbers and the chances of death are very, very, very small. I also understand human behavior and when the invisible boogie man might kill you, people panic and they stay indoors to watch the news. All day.

What blows my mind is that some people think we are facing a cataclysm of epic proportions. It has become clear that there will be hiccups to the global supply chain that will affect some businesses. Notice I wrote, some businesses, not all businesses. Some companies have relocated manufacturing back to the United States and they may be less affected.

One thing people forget about with investing is that we no longer have floor brokers at the New York Stock Exchange to help maintain orderly markets during times of stress. Our government felt that private electronic high frequency traders would do a better job. The only problem with this argument is that floor brokers are OBLIGATED to maintain an orderly market, high frequency traders are not obligated to do anything.

20 years ago, if you visited the New York stock exchange, this is what you saw:

Today, you only hear the hum of computers because over 80% of all trades done on the exchange are trades between computers – totally lacking in human discernment. For more on that story, go here.

Computerized trading is a HUGELY important to today’s discussion because, on volatile days, the computers are responsible for 90% of trades! Source: CNN These computers read electronic headlines and have the ability to listen for key words from commentators on the news networks. The keywords, both positive and negative, are given scores and the computers make trades based on the scores. The more negative scores, the more stocks are sold.

A curious thing happened last Monday, March 2nd – the Dow Jones Industrial Average went up 1,300 points 5%. How did this happen with all the bad news out there? Someone famous in the business world died over the weekend, Jack Welch, the former CEO of General Electric. On Monday, March 2nd, the news was dominated by the life of Jack Welch. I keep CNBC on in our office and on that day, I saw very few headlines about the virus – almost none, and the market soared because the computers had very few negative inputs.

Dow Jones Industrial Average (Friday, Feb 28th and Monday March 2nd). Source: ThomsonOne

So, while one of your stocks may be dropping, it might be because the computers are arguing amongst themselves over the value of your stock. If you panic and sell a good company while the price is down, you are probably feeding the machine your hard-earned money.

This leads me to opportunities. Consider the following:

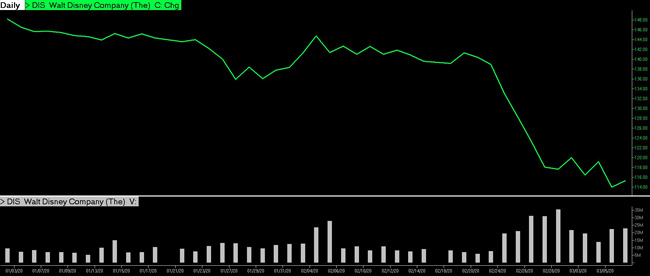

Disney Stock is down from $148 to $116 -21% Source: ThomsonOne

MicroSoft stock is down from $188 to $162 or -13.8% Source: ThomsonOne

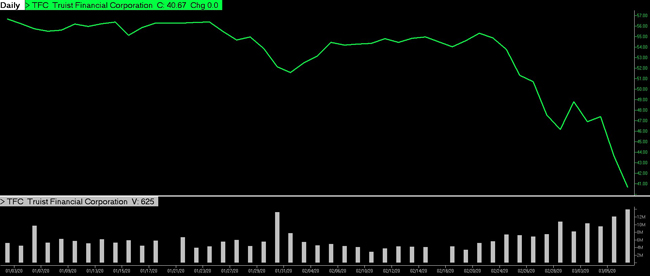

Truist stock (formerly BB&T and SunTrust) is down from $56 to $40 or -28% Source: ThomsonOne

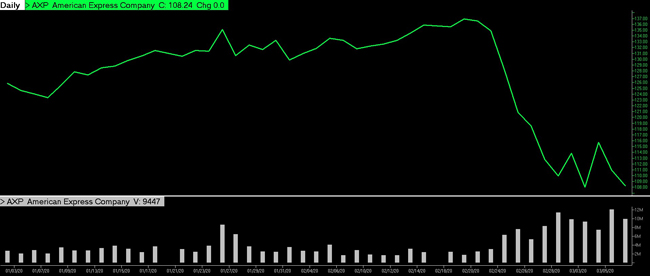

American Express stock is down from $137 to $107 or -22% (source: ThomsonOne)

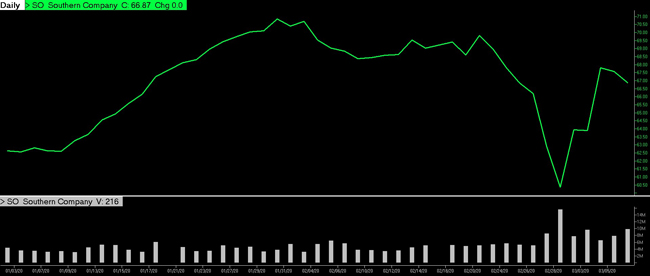

Southern Company stock went down from $70 to $60 or -14% before rebounding to $67. Source: ThomsonOne

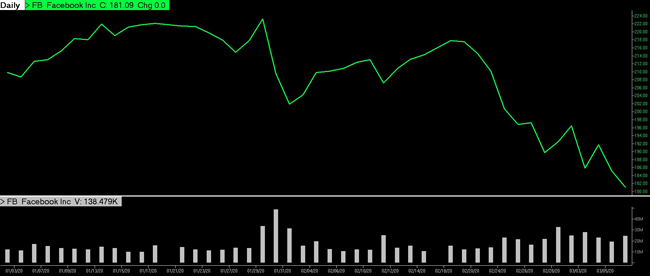

Facebook stock is down from $220 to $180 or -18% Source: ThomsonOne

I could go on with more examples, but you get the picture. There are so many good deals out there on good companies. If you panic and sell stocks at these low prices, I think you are simply feeding the machine you hard-earned money. Astute investors like Warren Buffett are not panicking and selling stocks and he does not use a high frequency trading system. Source: CNBC

The best advice I can give you today, is don’t panic and sell your stocks. Right now, our clients have some cash on the sidelines and we are looking for opportunities.

Enjoy this beautiful day. Enjoy the sunshine. Enjoy time with the special people in your life and ignore the machines.

David.Cross@us-am.com