Nearly everyone has heard the old saying, “Buy low and sell high” but I believe that nugget of “wisdom” has caused investors a great deal of pain over the years and so does Bill O’Neil, author of “How to Make Money in Stocks” and publisher of Investor’s Business Daily. (source quote)

In this note, I will share why the “buy low, sell high” should be replaced with “buy high, sell much higher” and what you can do to potentially increase your odds for investing success. Our aim is to help investors in our hometown of Atlanta improve their investing skills.

Buy low, sell high

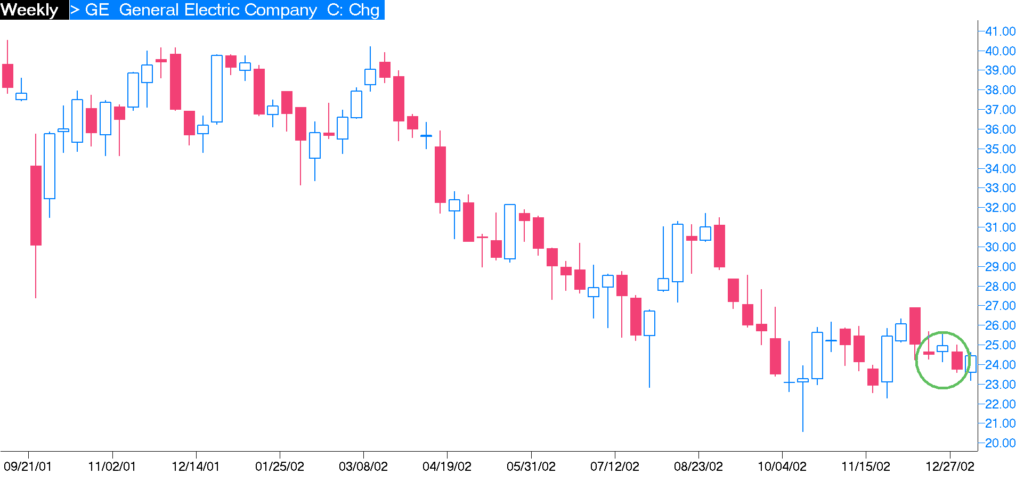

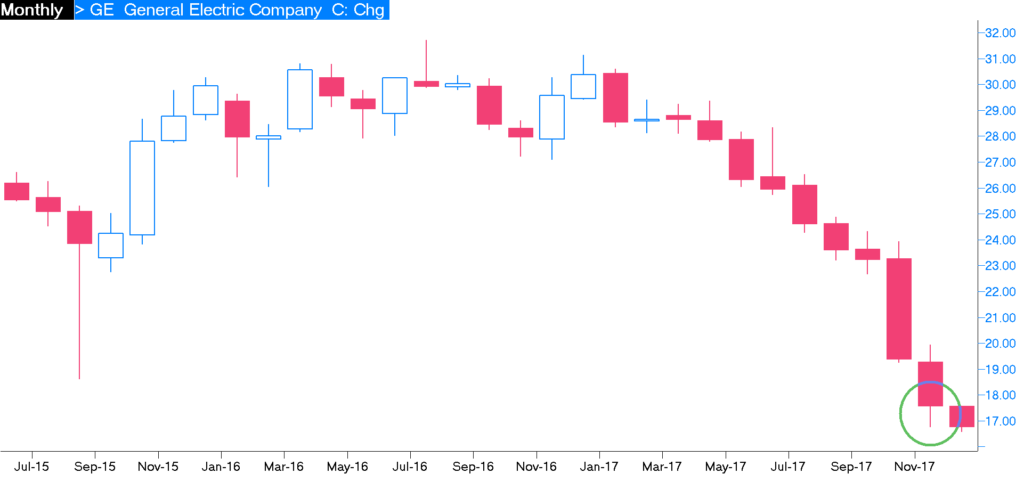

Let’s look at the stock chart of General Electric below:

Chart: ThomsonOne

From mid-1999 to late 2000, General Electric stock surged from around $32 to a peak of nearly $60. Imagine you saw the stock run up and then drop back to around $38. You missed the initial run and decide to buy 200 shares at $38 in September 2001 thinking you will buy low and sell high later at $50. From your buy at $38, the stock then drops to $24 in late 2002.

Chart: ThomsonOne

Some investors might be selling at $24, but not you, you are a long-term investor. You buy 200 more, doubling your position and reducing your cost to $31 thinking, “One day, it will get back to $50 and I can sell it for a nice profit.”

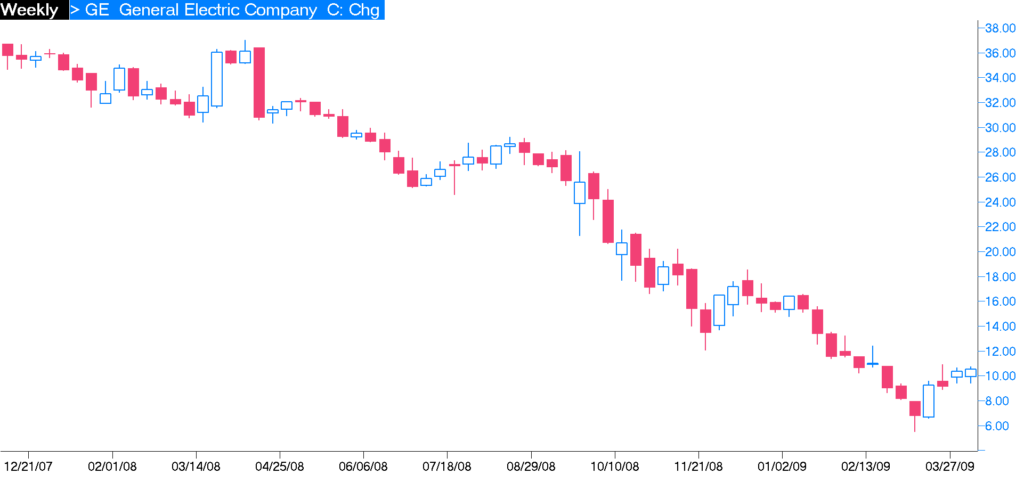

You sit and wait patiently – for 5 years. In 2007 the stock finally moves up to a high of $40. You’re thinking, I’m getting close. It will be $50 soon!

Chart: ThomsonOne

You’re so close! Then the stock drops in the financial crisis of 2008. General Electric stock hits $6. You don’t buy here because you’re frozen with fear like many investors, wishing that you had sold GE at $42 a year or so earlier.

Chart: ThomsonOne

Sidebar: If you think you would have bought at $6 during the crisis, you need to realize the stock was there for one single day, March 4, 2009. While I was trying desperately to market to new clients in Atlanta to get them to buy stocks, my experience was that most people were frozen with fear worried that their bank might fail.

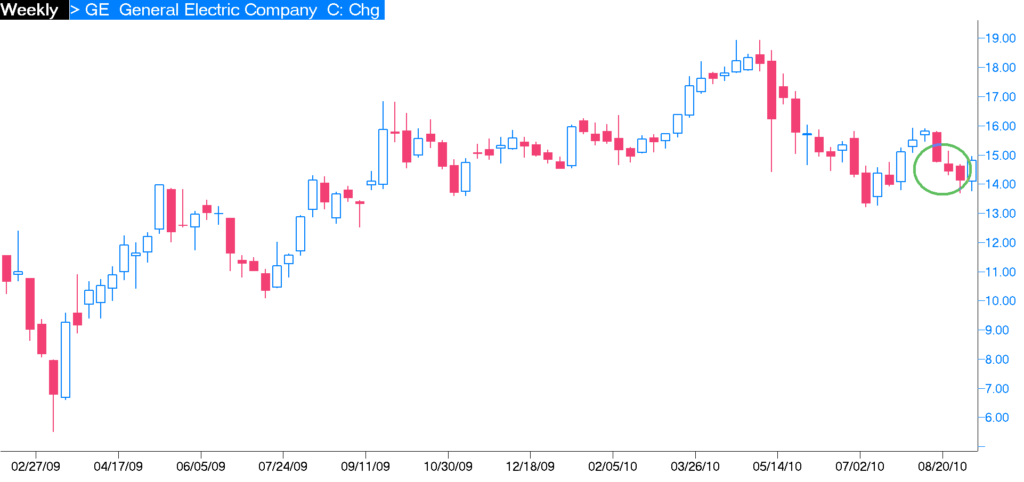

By 2010, the stock stabilizes around $15 and you decide to buy 200 more, tripling your original position to 600 shares and reducing your cost basis to $26. Now, if the stock will just go back to $40, you’ll sell it and make a nice gain.

Chart: ThomsonOne

You wait patiently again for 5 more years and by 2015, General Electric stock is back to $26. You’re at breakeven. You would have been better off in a money market fund so you decide to hold the stock for more gains. It must go up, right? It’s General Electric!

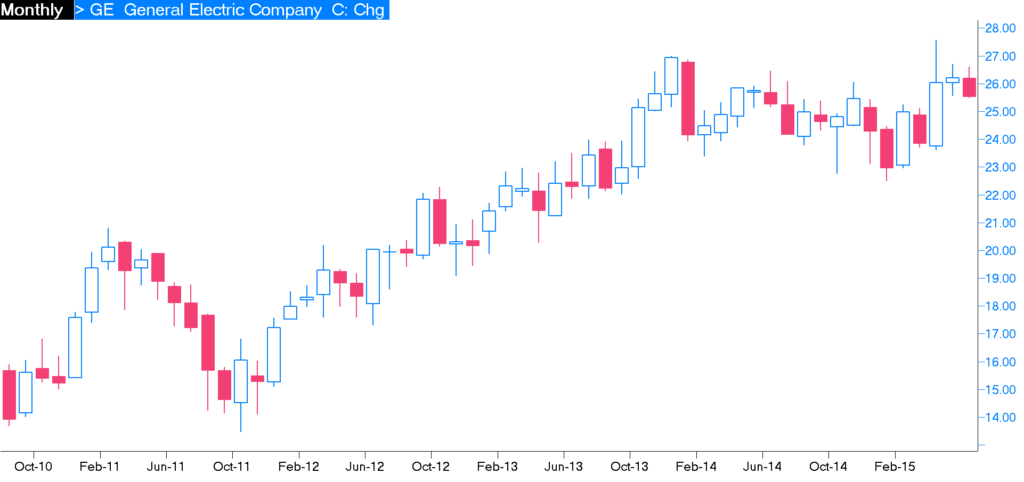

Chart: ThomsonOne

The next year, the stock reaches $33 in 2016. You’re thinking “Finally, it’s moving!” You think there are more gains coming and you’ll sell when the stock reaches $40 next year.

By 2017, the stock is declining rapidly, and General Electric stock ends the year at $17.45. You’re now sitting on a loss again and you think, it must go back up, so you buy 200 more at $17.45 and reduce your cost to $24.

Chart: ThomsonOne

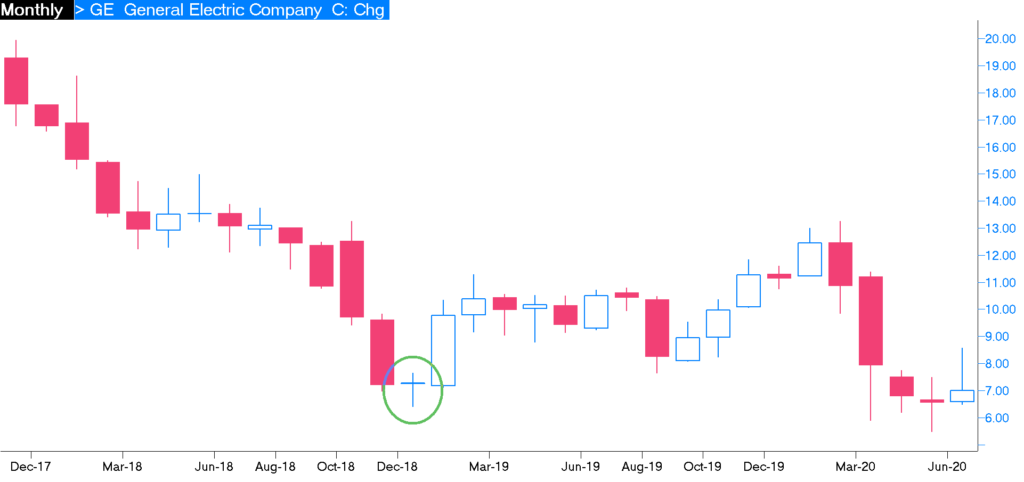

Now you wait for it to go back up. If it makes it back to $50, you’ll double your money for 17 years of holding! Forget $50! If it just makes it back to $24, you can get out of this disaster and move on.

The next year, the stock hits a new low at $6.66 per share. At $7.50 per share, you double up your position this time buying 800 additional shares. You now own 1,600 shares with an average cost of $15.50 and a total investment of about $25,000. If it will just go back to $15, you can sell this stock and be done with it forever. The stock bounces around for a year and by early 2020, it gets up to $13. Just $2 more dollars per share to go and you’ll finally sell this thing and get out!

But no. GE stock drops again with the pandemic of 2020 and finishes at $6.41 in mid-May. Your 1,600 shares and investment of $25,000 is worth $10,256.

Chart: ThomsonOne

You’ve had this “high quality, Blue Chip” stock for 20 years and all it has done is lose you money as you attempted to “buy low and sell high”. What could you have done differently?

May I suggest Buy high & sell much higher?

Consider the situation with Amazon over the same period.

Chart: ThomsonOne

From 1997 to early 2000, Amazon stock surges from around $2 to $113. Excitement gets the better of you and you buy 50 shares at the top at $113. Shortly after that, everything technology related drops like a rock to around $61. By late 2003, Amazon has recovered back to a new high of $61 and your buy 50 more shares. Your cost is now $87 for 100 shares or $8,700.

Chart: ThomsonOne

Over the next few years, the stock is volatile. You bought it at the high (again) and by 2006, the stock has dropped to around $26. You see the company growing sales rapidly, so you hold the stock. By 2007, it is back to $100 and your excitement gets the better of you. You buy 50 more shares for $100. You now own 150 shares with an average cost of $91.33, total cost of $13,700.

Chart: ThomsonOne

By 2008, the stock market crash has taken the stock down to about $35. You’re freaked out like many investors, so you don’t buy any more. By late 2009, the stock has recovered to $135. Wall Street analysts hate the stock because the company is not generating any net income, but you see that the sales growth is phenomenal, more and more of your friends are using Amazon and the cash flow is growing rapidly. You buy your final 50 shares at $135. Your cost basis has raised to $102.25 on 200 shares and your total cost is $20,450.

Chart: ThomsonOne

Over the next few years, Amazon sales growth is explosive. By 2020, the stock is volatile again with the pandemic but now Amazon stock is $2,437 per share. Your investment of $20,450 is now worth $487,400!

Chart: ThomsonOne

How did this happen? Blue chip stocks are supposed to be safe but General Electric lost while the new, risky company gained 25x on your initial investment.

Key Lessons I’ve Learned Over the Years

Stocks that are hitting new lows tend to hit more new lows on their way down.

- Stocks that are hitting new highs have hit previous highs on their way to the current high price.

- A large loss usually starts as a small loss.

- Never “average down” or buy stock at a lower price than your initial purchase. The market is telling you that your thesis is incorrect. Listen carefully to the market – it is the collective opinion of millions of people.

Opportunities Today

You might be saying, “That was Amazon. It was the best stock investment of the last 20 years! How can you possibly find another Amazon?” The truth is Amazon was not the best performing stock of the last 20 years. While Amazon has a 20-year return of 4,944%, there have been several other similar or better performing company stocks including:

- Netflix 38,763%

- Apple 10,498%

- Tractor Supply 12,744%

- Old Dominion Freight Lines 21,834%

- MasterCard 6,601%

- Intuitive Surgical 9,121%

- Monster Beverage 79,8004%

Chart: ThomsonOne

Today, we are looking for opportunities in rapidly growing, new companies with new products who are operating on sound financial footing. Not every company’s stock will work. It takes discipline and constantly checking in to see how the company is doing. With any luck, we hope to find excellent opportunities for our clients. This is how capitalism works. Old companies who do not adapt, die while new companies evolve to replace them. It is called creative destruction.

We will write about some opportunities that we see in upcoming investment briefs. We invite your questions and in-person visits from our neighbors in Gwinnett and metro Atlanta.

I believe investing today starts with a long-term financial plan integrated with a well thought out investment approach. If you have questions about how to invest or which investments may make sense for you, schedule an appointment by clicking this link or contact us today at david.cross@us-am.com or 678-894-0697.

David.Cross@us-am.com