I have had a lot of questions lately about what is going on with GameStop and what is causing the stock to catapult from 20 to 50 to 300 to 450. Clients have sent me articles that try to explain the situation as some type of coordinated attack by investors on Twitter or Reddit. In my opinion, it is none of that. As I see it, this is simply the machinations that happen inside the investment machine when you get a lot of smart people with their Master’s in Finance or a PhD in Astrophysics who think they know more than they really do. I will explain.

The first thing you need to understand is what is a short sale. In its simplest terms, a short sale is when you borrow stock that you do not own from somebody else, sell it at a high price today and then hope to be able to buy it back at a lower price. Your profit is the difference between what you sold the stock for and the price you paid to buy it back. Your average person is confused at this point and I understand – how do you sell something you do not own? Here is how:

Imagine that your neighbor is going out of town for a year and he asks if he can pay you to cut his grass this year. He is leaving in January and will be back next January. He says that you can use the brand-new lawnmower that is boxed up in his garage, or you can use your own. It does not matter to him. All he wants is for his grass not to be overgrown. You agree.

In July, because of Covid, you discover that there is a gigantic shortage of lawnmowers, specifically the one that your neighbor has boxed up in his garage. He paid $500 for it. Right now, people are offering $2500 for that same lawnmower. You call your neighbor and ask him if you can borrow his mower and he agrees – just so long as you replace it before he gets back home in January. So, you borrow it from him and sell it for $2500 thinking that when the economy cools off and the seasons change you will be able to buy that lawnmower back for $500 and replace the one you sold. You will have sold it for $2,500 and you will have bought it back for $500 generating a profit of $2,000. That is Short selling. You borrowed something, you sold it, you hope to buy it back at a cheaper price to replace it. Simple.

Now, to put this in the perspective of GameStop, imagine that you did this, but you did not know that 65 million of the other people in the country had done the same thing. In November or December, you plan to buy the lawn mower back is not going well. There is still a severe shortage and the price of that lawnmower is now $5000. Your neighbor is going to be home soon, and you need to replace the lawnmower. You wait for the price to go down, but it keeps going up. Your neighbor will be home any day now and the price is now $10,000. You have managed to lose $9500 on this simple transaction because you did not understand that everybody else had the same idea.

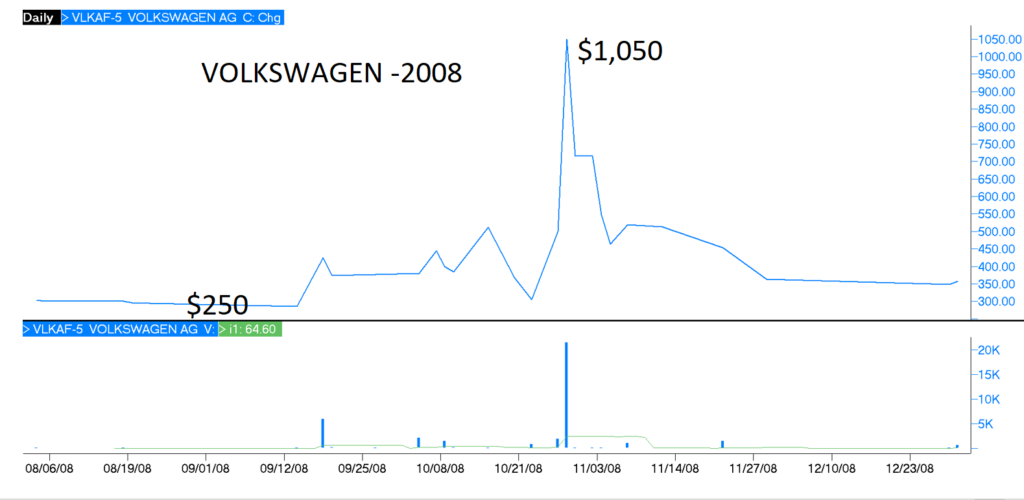

Just because people are talking about GameStop on Twitter or Reddit or wherever it does not mean that they have the buying power to move the market. I do not believe there was a coordinated attack by small investors. Markets are moved by the big money. What we witnessed in my opinion was coordinated stupidity by greedy people who trusted their investment models instead of common sense. This is not the first time this has happened, and it will not be the last. I saw a similar situation with a company called Iomega in the late 1990s and it happened again with VolksPorsche’s stock in 2008. It is called a “short squeeze”.

Chart Source: ThomsonOne

A “short squeeze” occurs when there are a lot of people who have borrowed stock to sell who will have to buy it back. It is called a squeeze because the eventual buying demand could force the stock to rocket higher in price due to limited supply. The squeeze can be compounded by large investors buying up stock knowing that people who are short must buy back. And, if you own that precious supply of stock, you can command a high price for it. This game tends to be played with a small group of people with very deep pockets like other hedge funds who are trying to create a squeeze and put their competitors out of business.

As of yesterday, there was well over $20 billion in losses on GameStop. That number will probably soar to $30 billion today. The situation could force these very smart investors to sell their good stocks to cover their losses on GameStop and the people who are caught short and cannot replace the stock they borrowed will suffer catastrophic losses.

Call us if you have questions about this or other investing issues. Investing today requires a customized financial plan integrated with a well thought out investment approach. If you have questions about how to invest or which investments may make sense for you, schedule an appointment by clicking this link or contact us today at david.cross@us-am.com or 678-894-0697.

David.Cross@us-am.com