Retirement is a major milestone in life, but figuring out if you have enough savings to retire comfortably can be a challenging math assignment. Financial security during retirement depends on a variety of factors, including your savings, investment returns, lifestyle goals, and life expectancy. There are some excellent free tools available that can help you quickly see if you are on track while our planning services can help you take a more in-depth and studied look at your situation.

Understanding the Basics of Retirement Planning

Before diving into how the basic calculator works, it is important to understand some essential retirement planning principles. First, you should consider your retirement age. Although some people retire earlier, many aim to retire between ages 62 and 67 while others never retire. Timing your retirement has a huge impact on your Social Security benefits and whether you will have enough to sustain your lifestyle – or if you will potentially run out of money.

Next, it’s crucial to estimate your annual expenses in retirement. This figure should include housing, healthcare, food, leisure activities, and any other costs you anticipate. U.S. Asset Management suggests aiming for a retirement income that is 60% to 80% of your current annual income to maintain your lifestyle. Factors like inflation and the potential for increased healthcare costs should also be considered.

Step 1: Inputting Personal Information

The first step involves entering basic details such as your age, household income, current retirement savings, and desired retirement age. The calculator also asks for your current savings rate—how much is contributed to your 401(k), IRA, or other retirement accounts.

Step 2: Defining Your Retirement Goals

Next, the calculator asks your income goal in retirement. Do you need 100% of your current income or 70%. The basic calculator handles the previous question while our custom designed plans will ask more in-depth questions like: Do you plan to travel frequently? Do you want to downsize your home or relocate to a lower-cost area? What is longevity like in your family? Do you plan to make gifts to children and grandchildren or charities? The answers to these questions will help determine your anticipated retirement expenses.

Step 3: Evaluating Investment Returns

The basic calculator asks you to estimate your asset growth rate. Our custom plans take into consideration investment growth factors based on historical performance and your investment preferences. We can use a combination of conservative, moderate, and aggressive investment strategies to provide a range of potential outcomes. However, it’s important to remember that past performance is not always indicative of future results, and investment returns can vary significantly.

Step 4: Adjusting for Social Security and Pensions

One of the key factors influencing many plans is Social Security benefits and pensions. After you input your estimated Social Security income the basic tool will project how much of your retirement expenses will be covered by this income. This can help you understand whether your savings and investments need to fill in any gaps. Our custom designed plans can help you understand the impact of retiring at various ages.

Step 5: Reviewing Your Results

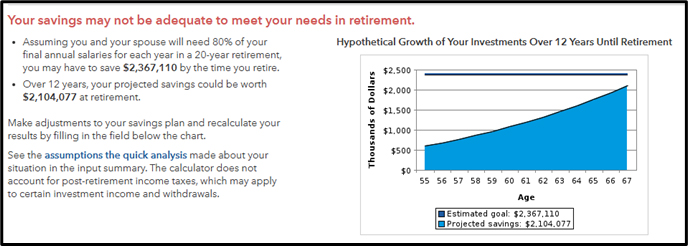

Once all the information is entered, the calculator generates a quick report that shows whether you’re on track to meet your retirement goals. There are numerous retirement calculators available out there, but our custom plans are easy to understand while still being comprehensive in their depth and ability to evaluate multiple “what-if” scenarios.

Conclusion

You may be fine with simple free tools. If you need more analysis, U.S. Asset Management has customized tools to help you calculate whether you have enough saved for retirement and what adjustments can be made to help you stay on track. By considering various factors like savings, lifestyle goals, and Social Security, you can gain a comprehensive view of your financial future. Whether you’re several years away from retirement or nearing the finish line, this tool can help you stay on track towards a comfortable retirement. As with any financial decision, it’s essential to assess your current situation and future expectations before choosing the right retirement strategy for you. That’s why we are here – to help you make those decisions. If you have questions about your situation, schedule an appointment by clicking this link or contact us at 678-894-0696.

Retirement Calculator With this simple tool, you can answer some brief questions about yourself and your future objectives and the calculator will let you know if you are generally on track, or not. If you have questions about your particular situation, we invite you to a complementary consultation so that you can gain greater insight and, if you engage us, we can build a plan to help you get there.

Financial calculators can be a wonder – if you know how to use them. Below are several tools we find helpful from time to time. If you know of a good tool that is not included here, let us know. And, if you have any questions with financial calculations or want help managing your finances, contact us today.

With this simple tool made available by American Funds, you can answer some brief questions about yourself and your future objectives and the calculator will let you know if you are generally on track, or not. If you have questions about your financial situation, we welcome the opportunity to offer a complimentary consultation. Together, we can explore your goals and discuss how we might assist you in developing a plan tailored to your needs.

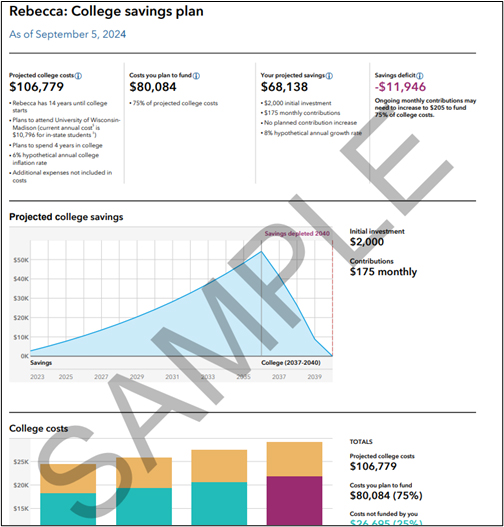

College costs have been climbing for some time and if you hope to get a handle on the future costs, it is better to start early. This tool will help you:

- Compare the costs of different colleges or use national averages for public or private colleges

- Consider scenarios where a portion of college costs will be funded by other sources (e.g., grandparents, scholarships, loans)

- Generate a personalized report that includes a summary of projected savings and costs, as well as tips and strategies for college savings

Figures shown in the report are hypothetical and for illustrative purposes only. Investing involves risk including the loss of principal.

Traditional vs. Roth 401(k)/403(b) Analyzer

If your 401(k) or 403(b) retirement plan accepts both traditional and Roth contributions, you have two ways to save for your retirement. Both offer federal income tax advantages.

Traditional accounts provide a tax break now. Traditional 401(k)/403(b) contributions are not taxed at the time of investment. Instead, taxes are paid on withdrawals, including any earnings. Getting a tax break at the time of investment will leave more money in your pocket now — money that you can invest, save or spend.

Roth accounts provide a tax advantage later. Roth 401(k)/403(b) contributions are made with money that’s already been taxed, so you won’t have to pay taxes on qualified withdrawals, including earnings.

Contribution limits, eligibility, and tax implications may vary based on income, filing status, and other factors. Investment performance, tax laws, and other conditions may affect individual outcomes.

Bankrate has a simple tool to help you evaluate the monthly mortgage payment when you are considering buying a home or refinancing. Be sure NOT to click on their offers as you could unleash a marketing storm to your email.

Required Minimum Distribution Calculator

Learn how much money the government requires you to withdraw from your IRA when you reach age 72 1/2

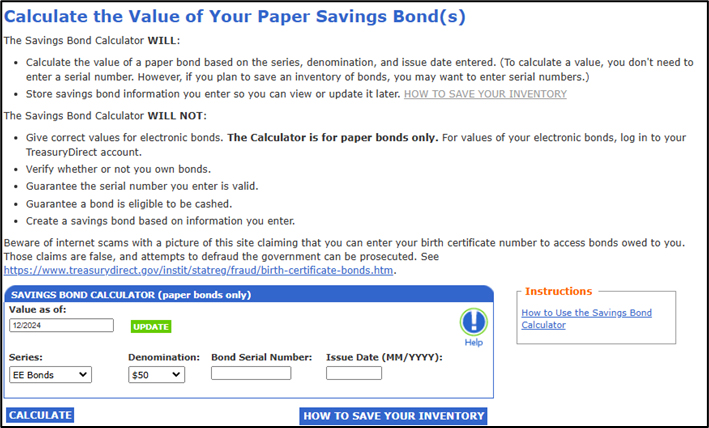

Learn the value of your paper United States Savings Bonds. The value could be significant and you may even find bonds that have matured and are no longer accruing interest.

You may be just fine with these simple free calculators. But, if you need more analysis, U.S. Asset Management has customized tools to help you evaluate just about any situation. Our job is to help you make better decisions with your money. If you have questions about your situation, schedule an appointment by clicking this link or contact us at 678-894-0696.

If you’ve been in the workforce for some time, you may have accumulated a pension benefit at one of your past jobs. And, when you are approaching retirement, you may be asked if you would like to take your pension as a monthly annuity or opt for a one-time lump sum payment. Both options have their advantages and drawbacks, and the right choice depends on various personal factors including your financial situation, life expectancy, investment risk tolerance, and long-term retirement goals. This article will explore how to evaluate these factors to help you make an informed decision.

Understanding the Two Options

- Monthly Pension (Annuity)

This option provides guaranteed, regular payments for the rest of your life (or the life of a spouse or beneficiary if you select a joint-and-survivor option). The amount you receive is typically based on factors like your years of service, salary, and the pension plan’s formula.

- Lump Sum Payment

With this option, you receive a one-time payout that you can roll over into a retirement account, such as an IRA, or invest in other vehicles. You take control of how the money is managed, and there are no guaranteed payments. How you invest the lump sum will directly affect your retirement income.

Pension plans and their guarantees are subject to the financial stability of the plan sponsor and the specific terms of the plan. Outcomes may vary based on individual circumstances and market conditions. Investing involves risk, including the loss of principal.

Factors to Consider

Guaranteed Income vs. Flexibility

One of the key differences between a pension annuity and a lump sum is the trade-off between guaranteed income and flexibility. However, the right choice depends on your unique financial circumstances, including your goals, risk tolerance, and life expectancy.

Pension Annuity

Provides a predictable, lifelong income stream. This can be particularly attractive for those who prioritize the security of knowing exactly how much they’ll receive each month, regardless of how long they live or what happens in the financial markets. However, this option may not keep pace with inflation unless the annuity includes cost-of-living adjustments, and payments depend on the financial stability of the plan provider.

Lump Sum

Offers greater flexibility because you control the money. You can invest it, spend it, or manage it as you see fit. This option allows you to potentially grow your wealth through investments, but it comes with the risk of poor investment performance, market volatility, or outliving your savings. It is essential to consider your financial knowledge, risk tolerance, and long-term goals when evaluating this option.

Life Expectancy

Your health and life expectancy are critical factors to consider.

Pension Annuity

If you expect to live a long time, an annuity can provide value by continuing to pay out for as long as you live. This is especially true for those who are in good health or have longevity in their family.

Lump Sum

If your life expectancy is shorter due to health issues, the lump sum may be more beneficial, as it allows you to access and use a larger portion of your pension upfront. Additionally, you may leave any unspent money to your heirs, whereas a pension annuity typically stops upon death (unless you’ve chosen a survivor benefit, which reduces the monthly payout).

Note: Lump sum distributions may have tax implications, and improper management may lead to financial penalties or reduced savings.

Investment Risk Tolerance

Your willingness and ability to take on investment risk should influence your decision.

Pension Annuity

If you prefer low-risk options and don’t want to worry about managing investments in retirement, the stability of guaranteed payments from a pension annuity is appealing.

Lump Sum

If you’re comfortable managing your investments and can tolerate the ups and downs of the market, the lump sum could potentially provide more value over time. However, this strategy carries risk. Poor investment decisions or market downturns could deplete your savings faster than expected.

Inflation and Cost of Living Adjustments (COLA)

It’s essential to know whether your pension annuity includes cost-of-living adjustments (COLA) to keep up with inflation.

Pension Annuity with COLA

If your pension provides annual increases to keep pace with inflation, it can help maintain your purchasing power in retirement. This is an important factor because inflation can erode the value of fixed monthly payments over time.

Lump Sum

With a lump sum, you can potentially hedge against inflation by investing in assets that may grow at a rate higher than inflation. However, this also depends on your investment success.

Estate Planning

Your estate planning goals should also influence your decision.

Pension Annuity

Once you pass away, the annuity typically ends unless you’ve chosen a survivor benefit, which reduces the monthly payment to ensure your spouse receives a portion of the pension. This leaves little to pass on to heirs.

Lump Sum

If leaving money to your heirs is a priority, the lump sum option may provide that possibility depending on whether or not there is money left in the account after your passing.

Conclusion

Deciding between a pension annuity and a lump sum payout is a deeply personal decision that depends on several factors, including your need for guaranteed income, health, risk tolerance, and long-term financial goals. If you value stability and guaranteed lifetime income, the pension annuity might be the right choice. However, if you prioritize flexibility, control over your investments, and potentially leaving a financial legacy, the lump sum may be a better option.

Consulting with a financial advisor can help you evaluate your specific situation and guide you toward the best choice for your retirement. Our job at U.S. Asset Management is to help you make better decisions with your money. If you have questions about your situation, schedule an appointment by clicking this link or contact us at 678-894-0696.